Topic 6: Misc. Questions

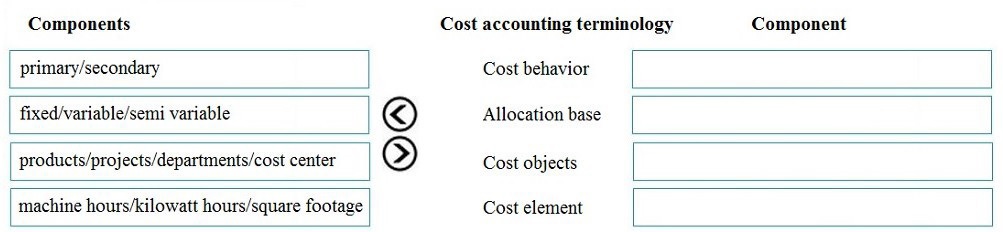

You are a controller in an organization. You are identifying cost drivers to see how changes

in business activities affect the bottom line of your organization. You need to assess cost

object performance to analyze actual versus budgeted cost and how resources are

consumed.

You need to demonstrate your understanding of cost accounting terminology.

Which component maps to the cost accounting terminology?

To answer, drag the appropriate component to the correct cost accounting terminology.

Each source may be used once. You may need to drag the split bar between panes or

scroll to view content.

NOTE: Each correct selection is worth one point

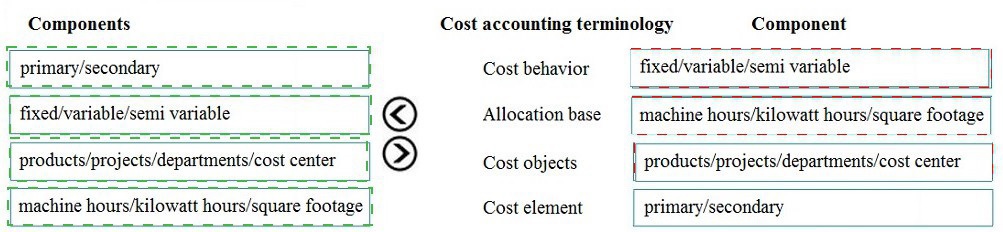

You are asked to configure foreign currency revaluation in Dynamics 365 for Finance and

Operations. You are viewing the main accounts,

A company plans to use Dynamics 365 Finance to calculate sales tax on sales orders.

You need to automatically calculate sales tax when the sales order is created.

Which three actions should you perform? Each correct answer presents part of the

solution.

NOTE: Each correct selection is worth one point

A.

Assign values to the sales tax codes and assign the sales tax codes to the sales tax

group associated to

the customer.

B.

Assign all sales tax codes to the item sales tax group associated to the item being sold.

C.

Set up a default item sales tax group on the item being sold and set up a default sales

tax group on the

custo

D.

Associate the sales tax jurisdictions to the item sales tax group associated to the item

being sold.

E. Set up a default sales tax code on the customer used on the sales order and set up a

default item sales tax

group on the item being sold.

Assign values to the sales tax codes and assign the sales tax codes to the sales tax

group associated to

the customer.

Assign all sales tax codes to the item sales tax group associated to the item being sold.

Note: This question is part of a series of questions that present the same scenario.

Each question in the series contains a unique solution that might meet the stated

goals. Some question sets might have more than one correct solution, while others

might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a

result, these questions will not appear in the review screen.

A client has multiple legal entities set up in Dynamics 365 Finance. All companies and data

reside in Dynamics 365 Finance.

The client currently uses a separate reporting tool to perform their financial consolidation

and eliminations. They want to use Dynamics 365 Finance instead.

You need to configure the system and correctly perform eliminations.

Solution: Select Consolidate online in Dynamics 365 Finance. Include eliminations during

the process or as a proposal. Set up the transactions to post in the legal entity configured

for consolidations.

Does the solution meet the goal?

A.

Yes

B.

No

No

Explanation: References:

https://docs.microsoft.com/en-us/dynamics365/unifiedoperations/

financials/budgeting/consolidation-elimination-overview

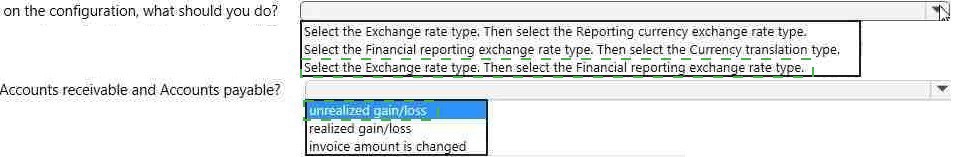

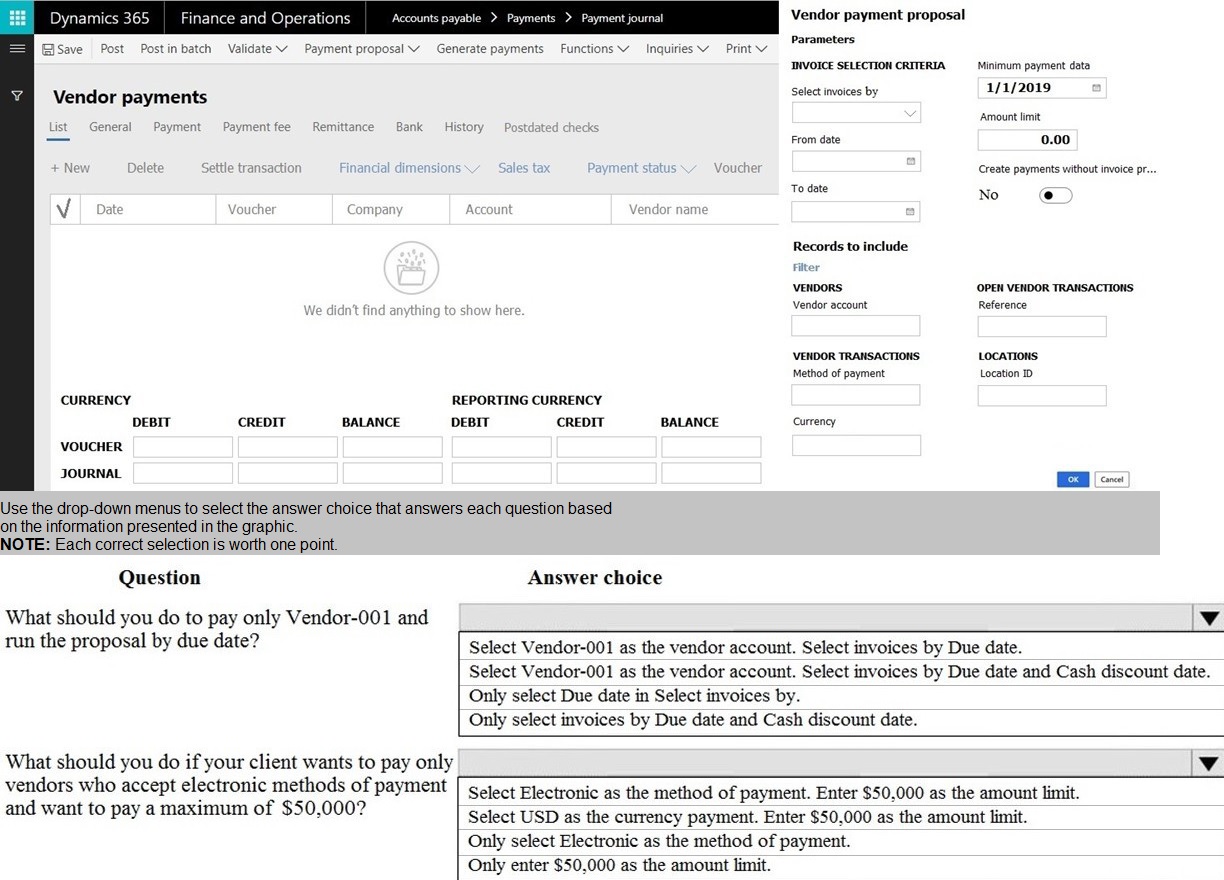

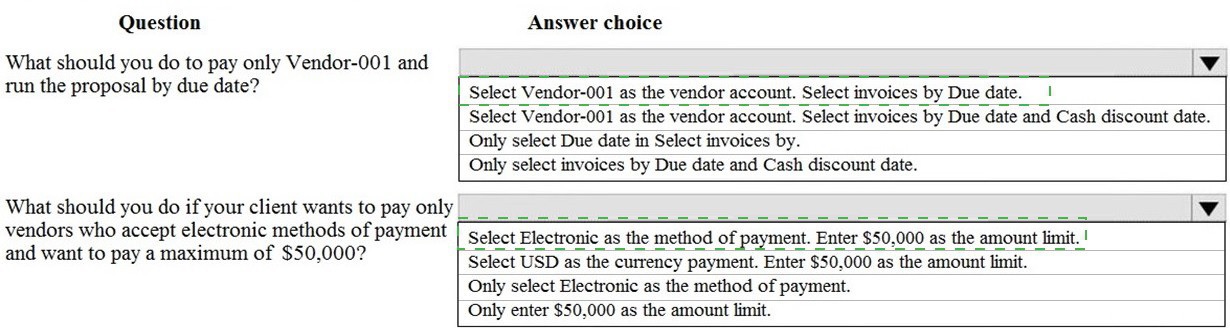

You are creating a payment proposal that shows invoices that are eligible to be paid.

You display the Accounts payable Payment proposal screen from the Accounts payable

payment journal.

A legal entity has locations and customers in multiple states within the United States.

You need to ensure that taxable customers are charged sales tax for taxable items in their

delivery location.

Which three settings must you configure? Each correct answer presents part of the

solution.

NOTE: Each correct selection is worth one point.

A.

the Sales tax group on the Customer record

B.

the Terms of delivery setup

C.

the Item Sales tax group on the Item record

D.

the Sales reporting codes

E.

the Sales tax codes

the Sales tax group on the Customer record

the Terms of delivery setup

the Sales tax codes

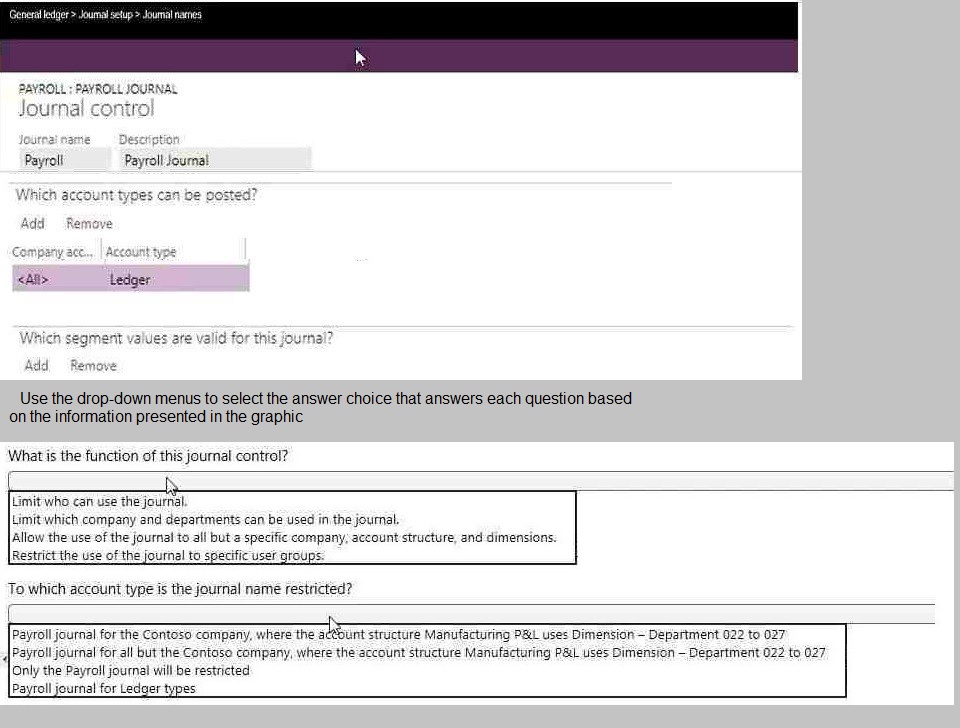

An organization plans to use defined journal names for each purpose. They want to ensure

that journal

processing is easier and more secure.

The organization has the following requirements:

Set up restrictions on the account type and segment values.

Capture data accurately for offset accounts, currency, and financial dimensions.

Maintain internal control and establish materiality limits.

You need to set up journal name elements to meet these requirements.

Which three journal elements should you configure? Each correct answer presents part of

the solution.

NOTE: Each correct selection is worth one point.

A.

workflow approval

B.

account type

C.

journal type

D.

default values

E.

journal control

workflow approval

default values

journal control

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/general-journalprocessing

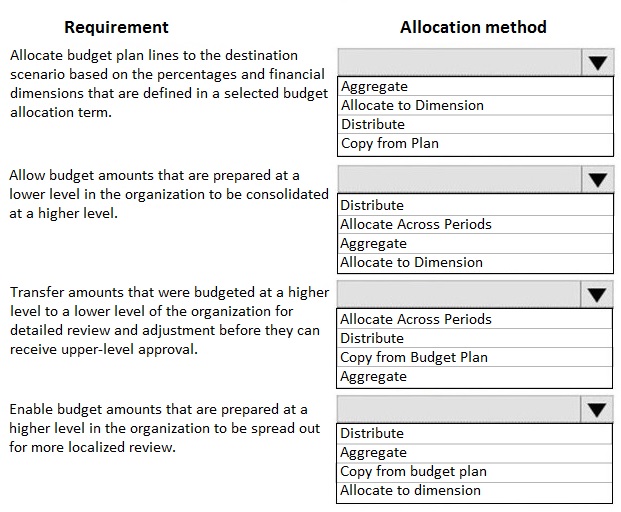

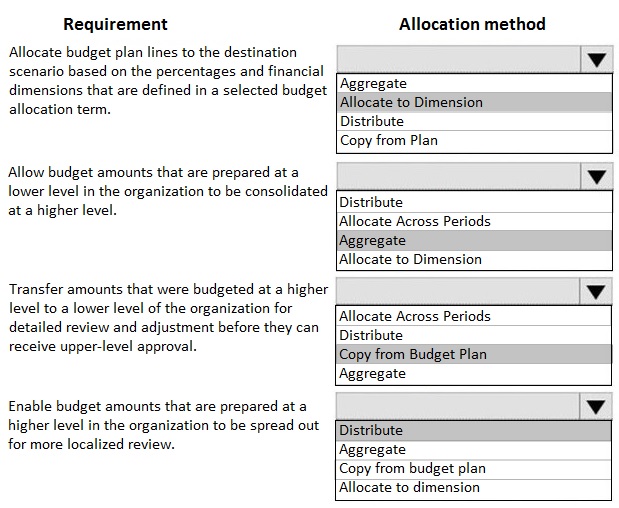

You are setting up a budget plan to accurately portray the projected budget for a company.

You need to select the appropriate allocation method for data distribution.

Which allocation methods should you use? To answer, select the appropriate configuration

in the answer area.

NOTE: Each correct selection is worth one point.

You must configure journal controls in Dynamics 365 for Finance and Operations.

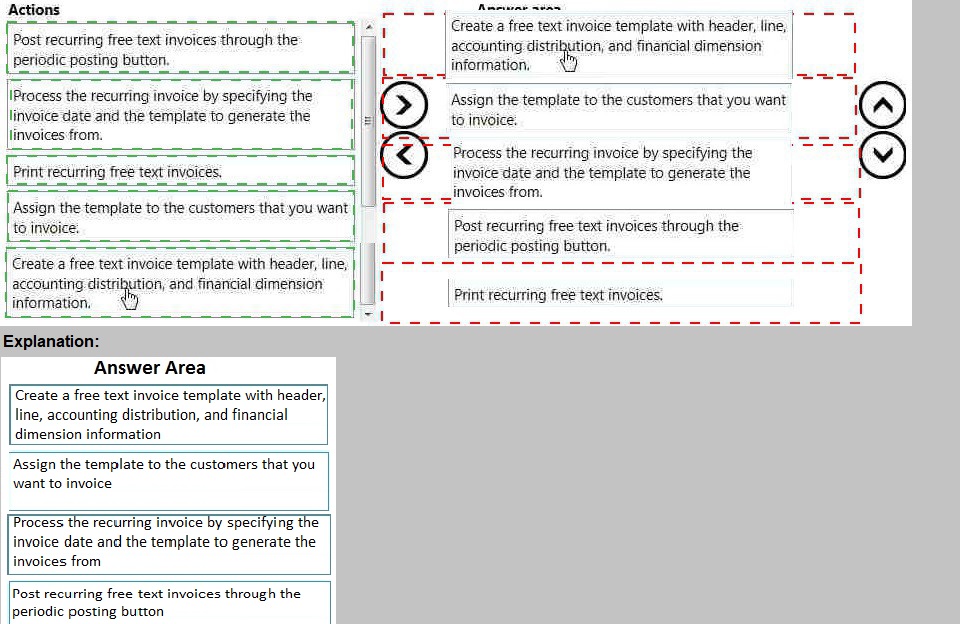

An organization sells monthly service subscriptions. The organization sends invoices to

customers on the 15th of every month in the amount of $450.00.

You need to set up, configure, and process recurring free text invoices for the customers.

| Page 5 out of 23 Pages |

| Previous |